What’s the cost of being unbanked?

When I was old enough to count, my parents gave me an allowance of coins. Pennies, nickels, dimes and quarters filled a tin. One day, my parents decided to take my sister and me to the Galleria to force us to spend all of our money to buy toys. It didn’t mean much to me at the time because in the short term, I didn’t have any use for the cash anyway, but I now see that it was a stepping stone for how I view things today.

My parents reinforced time after time the importance of saving money. I practiced keeping a ledger: a collection of financial debits and credits, and learned about the force that drives the world: money.

I opened my first savings account in middle school. I especially remember when I visited the Fidelity building for the first time in seventh grade, a green color-coded haven.

From keeping track of what was in my wallet to what I had saved in the bank, this sparked my interest in becoming an accountant. Organizing the ins and outs of inventory over long periods of time just gave me a sense of satisfaction and accomplishment, like how I feel whenever I’ve completely mastered a topic in math class.

While my parents are proactive in my financial education, I know that many other kids my age don’t have the same experience. I remember feeling a bit shocked to hear that the treasurer of my club had never heard of a ledger.

While it may feel unnecessary to have a bank account now, since “I’m just a kid,” opening an account will make you much more prepared for becoming an adult, which isn’t too far away for most high school students. I’m sure that many of us students complain that the “education system doesn’t teach us how to file our taxes,” so let’s at least do the bare minimum and open an account.

Living in the fourth largest populous city in America, we are surrounded by 2.3 million people in Houston alone. I recently learned that of those citizens, 10% of households are unbanked in 2021. Texas’s population as of 2022 was above 30 million, with around 5.6% of them being unbanked in 2023.

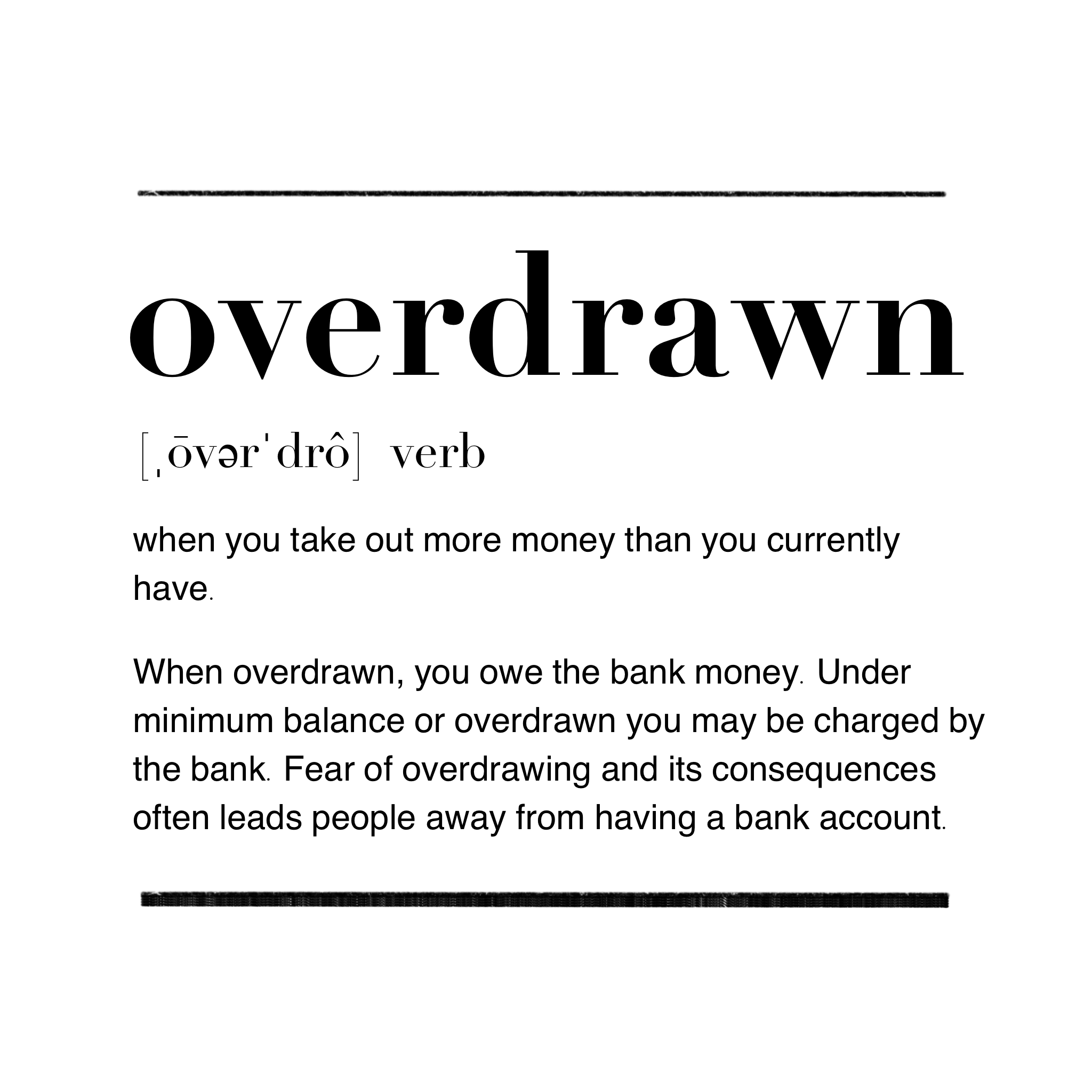

People who are unbanked are those who do not use any services given by banks. Underbanked is a similar term, referring to families that have a checking or savings account but rely more on alternative services to banking like unbanked persons (i.e. check cashing or payday loans).

Not only is being unbanked unsafe and unpredictable, it can also trap people in poverty without protected wealth.

According to the FDIC (Federal Deposit Insurance Corporation), people who are lower income, less educated and people of color are most likely to be unbanked, with more than 20% of Latinx and around 15% of Black Houstonians being unbanked as of 2021.

Immigrants also tend to be unbanked because they may be unsure about how long their stay in America is. Lack of knowledge on American banks can also bring a sense of distrust.

The less educated tend to have not as informed decisions on trust or just knowledge on banks and therefore remain non reliant on them. Undocumented immigrants similarly feel untrustworthy of banks because of fear of being deported.

People of lower education tend to also have a lower income and have trouble meeting minimum balance requirements, privacy concerns or want to avoid paying fees.

People with lower income may also live in bank deserts (places far from banks), giving them little to no access to banking services.

Have you ever heard the phrase: “It’s expensive to be poor?” Well, that term definitely applies here too.

When using alternative banking choices, it costs money to cash in checks, and payday loans can potentially cost extremely high interest fees.

A payday loan is a loan people normally take from non-bank lenders for normally around $500 and is supposed to be paid back by the next paycheck. However, one can extend the due date of when to return the money with around a $20 fee.

As for sending money overseas, wiring costs can go up to $50, although if using a bank, there is a set cost for each bank of around $15, or at most $45, for it to be sent.

Some working class people are paid “on credit card,” meaning they have a plastic card that has all of their wages, not a bank account. While this might be good temporarily, if you lose or have the single card stolen, that’s all your money gone with a poof!

With money outside of a bank account floating around either in cash or card, it has a higher risk of being lost and unprotected.

It costs much more to be unbanked.

When you’re underage, you can have a bank account under your parents name until you turn 18. Once you meet age requirements, the account becomes yours and parents no longer have access to it.

Having a bank account provides:

- Preparation for work, school, friends and the future.

- Paypal, Venmo and Cash App accounts may not need a bank account, but to put in money, one has to enter their debit or credit card number.

- As for jobs, whether it’s part-time or full, they normally need a checking account or something else they can access for payment. It makes business transactions easier between parties, as someone may not always be accepting of alternative payment.

- Protection

- Federal laws protect your money from fraud, theft and safety in case of a disaster.

- For example, you get an account with Bank of America. One day everything blows up: your wallet, your house and your local bank. If you go to another Bank of America, they will be able to help you retrieve your money. It’s like insurance without all the extra steps.

- The whole point of my parents’ exercises when I was little was to teach me about saving money. While I could’ve learned that without a savings account, I would have money lying around that could beー once againー stolen or destroyed. Then I would’ve saved nothing.

- Easier access

- When you cash in your checks or communicate with others for loans, they may not always be available or one may not always have access to these services. While banks are not open 24/7 either, they have consistent schedules and immediate access through card or direct deposits through payment. Through direct transfer, it’s faster and safer.

- FUN FACT: The bank can’t deport you.

- Students or people who are still undocumented, I hope you are reassured if this was a fear.

- For most banks, when you open a bank account, you typically need a Social Security Number or an Individual Taxpayer Identification Number. If one doesn’t have an ITIN or SSN, they can apply for one via the IRS.

- Here is a list of banks that allows one to open a bank account without a SSN, although some banks may ask for further identification, like passports, photo IDs, or an address. For more information about deportation, you can visit usa.gov.

Different banks have different requirements, so it’s important to do a little research behind each bank to see what they need. Having a supervised bank account can also be easier if your parent also has a bank account under the same bank.

Opening a bank account under…

- Capital One

- Bank of America

- Well’s Fargo

- Or you can use this list from earlier for opening a bank account without a Social Security Number.

To decrease the number of unbanked in Houston, Bank on Houston is a program that collaborates with the Federal Deposit Insurance Corporation (FDIC), banks and other organizations to help people find “low-cost bank accounts that are free of excessive bank requirements.”

Your donation will support the student journalists of Bellaire High School. Your contribution will allow us to purchase equipment and cover our annual website hosting costs.

Joy Xia • Dec 20, 2023 at 9:55 am

I really like this topic. Thank you for addressing it!

Kate Steinbach • Nov 7, 2023 at 12:25 am

Great story! I thought that this was very informative!