A digital scam for a digital age

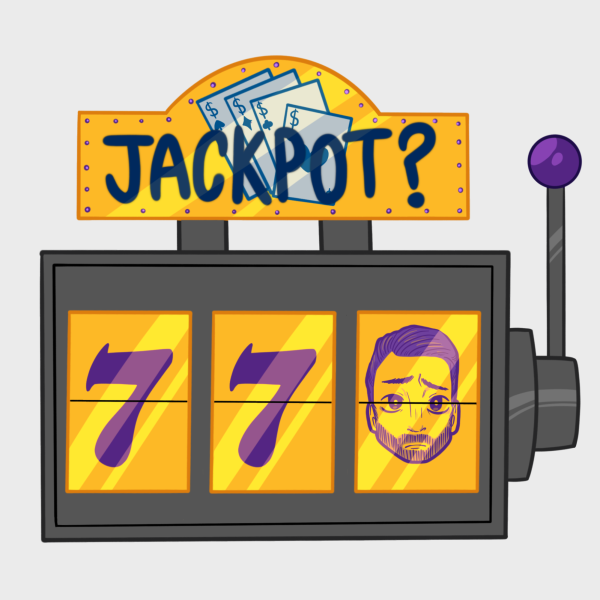

Why NFT’s are a bad idea and a bad investment

There’s a recent topic making its circles around the ever-talkative world of the internet. Of course, this isn’t anything out of the ordinary. There is always something gossip worthy floating about in the mouth of the internet: controversies, rumors, politics, sports, movies, video games; anything you can possibly think of is likely already being talked about in some obscene corner of the digital universe.

But this topic in particular baffles me. Because this time, out of all the absurd and blatantly ridiculous ideas that the human psyche could conjure up, it’s about a $1000 image of a poorly made piece of art.

This recent phenomenon of buying a digital piece of art for an unreasonable price can be summed up in three letters, those letters being a capital N, F and T.

“NFTs” or “Non Fungible Tokens” are a recent form of…art? Products? Assets? To be honest, I’m not too sure on what they can be considered as. On the surface, they look like poorly drawn, mediocre pieces of art, selling for prices that are a tad bit out of touch with reality .But if you look into it further, NFTs are a lot more complex (and worse) than just overpriced pieces of art.

NFTs are, to sum it up in the plainest of terms, “one-of-a-kind” digital art or assets. This art can be bought, sold, traded, trademarked and everything else in between. The only difference between NFTs and physical art, excluding their vastly separate standards of quality and value, is the digitized nature of NFTs.

NFTs cannot be physically purchased from your local art gallery, because they have no physical form to begin with. Instead, they are sold on digital “NFT Marketplaces” such as OpenSea, NiftyGateway, Rarible, Foundation and many more. Instead of paper-money, the medium of exchange translates to forms of crypto currency, most notably bitcoin.

The idea, as is with all digital assets, is to create a chain of supply and demand until the theoretical value of the asset shoots through the roof. However, the problem with this sort of trade is that the product or asset has no inherent value or worth.

The value of an object comes from our own perception of it, which is heightened by factors like its exclusivity, demand, trend, and standardization.

These factors are exactly what NFTs have been exploiting.

Like I said before, NFTs claim to be a “one-of-a-kind” digital artwork. The only problem is that the phrase “one-of-a-kind” is buried so deep into the essence of an NFT, that it loses all of its meaning. Because what makes an NFT unique and exclusive doesn’t have anything to do with the visual aspects of it, rather, what makes an NFT one-of-a-kind is the purchase of it.

Basically, when someone pays for an NFT, they’re paying for a certificate of ownership. A kind of receipt that you would get at checkout from a grocery store, only in this case, the receipt is permanently embedded onto the internet in a chain of multiple other receipts just like it.

Have I confused you yet? If so, good. Because it’s only going to get worse.

The Blockchain

Also known as the bane of my brain. In all honesty, I’m still not completely sure if I understand what this term refers to. But I’m going to make an attempt to explain it nevertheless. For the sake of simplicity, and my sanity, lets just refer to it as a bank.

Everytime someone purchases an NFT, this bank makes a record of that purchase, and stores the record on the internet. This record is forever embedded onto the internet in a chain of multiple other records just like it and can supposedly never be modified from the outside by anyone or anything. This, in concept, is the essence of a blockchain.

Of course, this is also an oversimplification of how the blockchain works. Since its actual processes and execution are beyond my understanding.

Okay, but what’s the big deal?

The big deal is how this thing operates. Because instead of a manual workforce, the blockchain runs completely and absolutely on digital computation.

Thousands of computers across the globe are used to power this technology by using a peer-to-peer network, which equally distributes the amount of power necessary between each computer to keep the technology afloat.

Well…alright, but what’s wrong with that? Isn’t most of the world today powered by computers anyway?

You might think that, and you’d be right, but what makes blockchain technology different (and in my opinion, detrimental) is the enormous cost and consequence. Because computers, like all things on this planet, need energy to function. And in this case, that energy is electricity.

Most of which is generated by using steam turbines that use fossil fuels such as coal. The usage of such fossil fuels emits high amounts of greenhouse gasses and other air pollutants into the atmosphere such as carbon dioxide and nitrogen oxide. These gasses are the primary cause of climate change and increasing temperatures around the globe.

Add that to an increased risk of acid rain, smog, toxic air and water pollution, and you’ve just got yourself a prime example of self destruction.

But what does any of this have to do with the blockchain?

Remember how I said the blockchain is run on the power of thousands of computers? Well, to power those computers, an equally immense, if not greater, amount of electricity needs to be generated.

In fact, an article written last September by the New York Times states that “The bitcoin network uses seven times as much electricity as all of Google’s Global operations.”

To put that value into context, Google’s energy consumption in 2019, according to Forbes, was about 12.4 terawatt-hours of electricity per year. The energy consumption of all humans on the planet is about 17.7 terawatt-hours. Let that sink in, Google uses nearly 70% of all human energy consumption. And the blockchain uses seven times that amount.

So multiply 12.4 terawatt-hours by seven. Because to me, it is clear that we are stretching human energy uses, and our very atmosphere to limits that it cannot, and should not, be reaching.

Okay, that’s bad, but how do NFT’s fit into this?

As I mentioned previously, when someone pays for an NFT, they are paying for something of a receipt that identifies them as the owner of that NFT. Basically like a certificate of ownership. A certificate of ownership that’s stored on the blockchain for everyone to look at.

And that’s it.

They don’t have any exclusive rights to the NFT. They can’t stop other people from replicating the NFT. And the artist of the NFT still holds all of its copyright.

The only thing they get is a small piece of text in an infinitely long chain of public transactions, identifying them as the owner of an image. So, what was actually paid for is a piece of text saying ‘someone owns this.’

Anyone else who has even the slightest fraction of knowledge on how a computer and a mouse works, and can access the internet, can instantly create an exact visual and artistic replica of the same thing that some poor soul paid thousands of dollars for.

And they can do that by simply lifting a finger and right clicking on their mouse. So, technically speaking, an NFTs proudly proclaimed “exclusivity” is just as artificial and baseless as the subject itself.

So what’s the takeaway from all of this?

NFTs are worthless.

That’s the takeaway. At least that’s my takeaway. Paying thousands of dollars for an image that literally anyone else on the planet can have for free, while simultaneously polluting the environment, is a terrible choice that I would no doubt regret later on.

And I mean come on, I’m 16. I don’t want to start making terrible life choices just yet, I have my 20’s for that. Not that I’m going to buy an NFT even when I’m 20 years old. Or ever.

Your donation will support the student journalists of Bellaire High School. Your contribution will allow us to purchase equipment and cover our annual website hosting costs.